我反對前面幾乎所有答案。 包括提問的,經濟總量根本無法代表州的窮富啊,同樣,一個物價高得地區和物價低的地區開薪資差異也無法彌補地區差異。

例如加州開7-10萬都無法和俄亥俄的5萬比。我們這邊全10分學區297平 (3200 sqft) 10年房+.55英畝的地才30萬美元上下。你加州同樣學區和地得200萬線了吧?

此外州本身預算也是問題。 有些州GDP很高,然而萬稅後還是入不敷出,面臨破產,你說這個州富有麽?

那麽我們從州和個人來看富有吧:

州財政情況(負債率越低的州說明遇到情況時可以呼叫資源相對多,有錢可花):

全美最富的州:阿拉斯加 -- 州資產786億美元,負債106億美元, 負債率僅僅是13.5% 凈值680億美元高踞全美絕對數值第三。 因為州資產如此充分,阿拉斯加州是美國七個不受個人所得稅的州之一。 因為他們從石油和天然氣裏的稅就能讓這個州如此之富了。。。

第二到第十分別是:

內不拉斯加:州資產151億美元,負債22.5億,負債率 14.9%

南達科他:州資產74.1億美元,負債11.7億,負債率 15.8%

田納西:州資產410億美元,負債72億,負債率17.5%

愛達荷:州資產153億,負債32.8億,負債率21.3%

奧克拉荷馬:州資產230億,負債51億,負債率22.1%

懷俄明:州資產241億,負債55.6億,負債率23%

北卡羅來那:州資產668億,負債155億,負債率23.2%

猶他州:州資產312億,負債76.7億,負債率24.5%

北達科他:州資產265億,負債69.5億,負債率26.2%

全美債務最深的州:

紐澤西:州資產562億,負債1765億,負債率314.1% 已經可以破產3次了。 最核心的問題,高福利和原來制定的州退休金標準

伊利諾:州資產662億,負債1889.3億,負債率303.7% 同樣和紐澤西難兄難弟,沒排第一是因為紐澤西資產更少,所以債務率高。 核心問題還是福利債務。

麻薩諸塞:州資產362億,負債892億,負債率245.8% 繼續,福利債務

康乃迪克:州資產297.5億,負債676.1億,負債率227.2%

肯塔基:州資產350億,負債496.3億,負債率141.6%

加利福尼亞:州資產2494億,負債2797.5億,負債率112.2%

馬里蘭:州資產485億,負債509.2億,負債率105% 馬里蘭的問題主要是州的醫療補助問題嚴重。

羅德島:州資產707億,負債737億,負債率104.2%

夏威夷:州資產 212.4億,負債198.7億,負債率93.6%

路易士安那:州資產311.6億,251億,負債率80.6%

其他的州中,紐約,賓夕法尼亞都是80% 屬於危險線。 路易士安那負債率高主要是因為幾次颶風對州資產損失很大。 造成的負債比較多,但由於資產回升,負債率也是快速走低,和其他州結構性負債有所不同。

大家覺得那個州更富有呢?

由於聯邦稅率是各州一樣的, 那麽各州稅率就是造成收入的主要差距(大型城市的城市稅有額外影響)。 這裏還要加入物價水平對於實際收入的影響。

在這裏我首先根據物價水平取了州家庭中位收入的調整後真實收入。 然後加入所在州稅率(DC使用了城市稅 8.5%) 從而得到了真實收入(住大城市裏的有額外的稅,這裏就先忽略了)得到結果如下:

全美家庭(household, 通常定義是一夫一妻,外加2個子女)州稅後(聯邦/城市稅前)真實收入倒數前10的州

1。密西西比:$42,703

2。西維吉尼亞:$42,822

3。阿肯色:$43,729

4。新墨西哥: $43,776

5。紐約州: $45,893 (對,你沒看錯,紐約州就是加上紐約市,稅後均收入也是美國倒數前5,這裏還不算紐約的市稅)

6。 路易士安那: $46,216

7。佛羅裏達: $46,375

8。肯塔基: $46,547

9。緬因: $46,754

10。愛達荷: $47,618

美國家庭收入最富的10個州(標準同上)

1。阿拉斯加 $66,033

2。馬里蘭 $62,663

3。新罕普舍爾 $62,221

4。麻薩諸塞 $60,102

5。 北達科他 $59,907

6。佛吉尼亞 $59,623

7。 猶他 $59,435

8。 華盛頓特區 $59,144

9。 康乃迪克 $58,947

10。 明尼蘇達 $58,423

綜合所有數據來看,阿拉斯加的真實家庭收入大概是密西西比的1.55倍,但是阿拉斯加的工作機會相對較小(石油,漁業,林業),氣候也比較惡劣。 (同樣的還有新罕普舍爾,北達科他,猶他和明尼蘇達)

考慮到州政府負債情況(對未來加稅的預期,例如麻省負債高達245% 你說他未來不加稅減福利我都不信,類似的還有康乃迪克),收入/稅率/教育水平,我個人認為馬里蘭-維吉尼亞一線地區還是相對比較好的選擇。

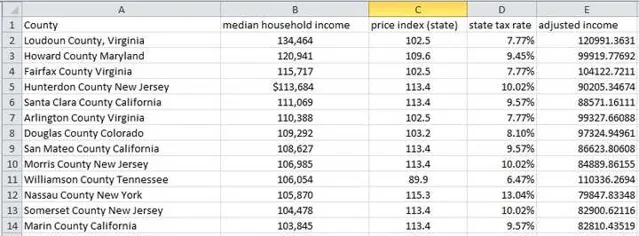

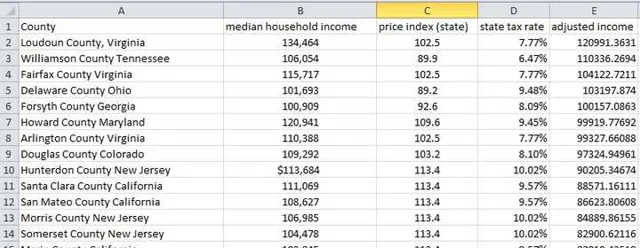

順便查了一下美國各郡的家庭均收入情況。

全美一共有16個郡家庭均收入在10萬美元以上。 算是中產裏的頂尖水平(因為豪富基本上不收薪資,生活和公司走,所以「收入」反而不好統計,這是薪資水平來算的。 所以說是中產頂尖代表。

他們分別是:

然後我們按州稅和物價進行調整(有些州如俄亥俄,田納西還有喬治亞的物價低,實際購買力強)後如下

我發現我所在的Delware county OH的大家真富啊。。。全美第4。。。另外靠近DC的油水真多,全美前三裏倆是他們

----------------------------基礎數據的分割線----------------------

格式:

州:

州家庭(一夫一妻+2子女為標準)中位數收入

地區物價(對比全國均價)

真實收入水平。

* 註意,這裏並不考慮各州稅率。全部收入是稅前收入購買力計算

Alabama

* Median household income: $44,765

* Regional price parity out of 100: 86.8

* *Real income: $51,573*

Alaska

* Median household income: $73,355

* Regional price parity out of 100: 105.6

* *Real income: $69,465*

Arizona

* Median household income: $51,492

* Regional price parity out of 100: 96.2

* *Real income: $53,526*

Arkansas

* Median household income: $41,995

* Regional price parity out of 100: 87.4

* *Real income: $48,049*

California

* Median household income: $64,500

* Regional price parity out of 100: 113.4

* *Real income: $56,878*

Colorado

* Median household income: $63,909

* Regional price parity out of 100: 103.2

* *Real income: $61,927*

Connecticut

* Median household income: $71,346

* Regional price parity out of 100: 108.7

* *Real income: $65,636*

Delaware

* Median household income: $61,255

* Regional price parity out of 100: 100.4

* *Real income: $61,011*

District of Columbia

* Median household income: $75,628

* Regional price parity out of 100: 117

* *Real income: $64,639*

Florida

* Median household income: $49,426

* Regional price parity out of 100: 99.5

* *Real income: $49,674*

Georgia

* Median household income: $51,244

* Regional price parity out of 100: 92.6

* *Real income: $55,339*

Hawaii

* Median household income: $73,486

* Regional price parity out of 100: 118.8

* *Real income: $61,857*

Idaho

* Median household income: $48,275

* Regional price parity out of 100: 93.4

* *Real income: $51,686*

Illinois

* Median household income: $59,588

* Regional price parity out of 100: 99.7

* *Real income: $59,767*

Indiana

* Median household income: $50,532

* Regional price parity out of 100: 90.7

* *Real income:* *$55,713*

Iowa

* Median household income: $54,736

* Regional price parity out of 100: 90.3

* *Real income: $60,616*

Kansas

* Median household income: $53,906

* Regional price parity out of 100: 90.4

* *Real income: $59,631*

Kentucky

* Median household income: $45,215

* Regional price parity out of 100: 88.6

* *Real income: $51,033*

Louisiana

* Median household income: $45,727

* Regional price parity out of 100: 90.6

* *Real income:* *$50,471*

Maine

* Median household income: $51,494

* Regional price parity out of 100: 98

* *Real income: $52,545*

Maryland

* Median household income: $75,847

* Regional price parity out of 100: 109.6

* *Real income: $69,203*

Massachusetts

* Median household income: $70,628

* Regional price parity out of 100: 106.9

* *Real income: $66,069*

Michigan

* Median household income: $51,084

* Regional price parity out of 100: 93.5

* *Real income: $54,635*

Minnesota

* Median household income: $63,488

* Regional price parity out of 100: 97.4

* *Real income: $65,183*

Mississippi

* Median household income: $40,593

* Regional price parity out of 100: 86.2

* *Real income: $47,092*

Missouri

* Median household income: $50,238

* Regional price parity out of 100: 89.3

* *Real income: $56,258*

Montana

* Median household income: $49,509

* Regional price parity out of 100: 94.8

* *Real income: $52,225*

Nebraska

* Median household income: $54,996

* Regional price parity out of 100: 90.6

* *Real income: $60,702*

Nevada

* Median household income: $52,431

* Regional price parity out of 100: 98

* *Real income: $53,501*

New Hampshire

* Median household income: $70,303

* Regional price parity out of 100: 105

* *Real income: $66,955*

New Jersey

* Median household income: $72,222

* Regional price parity out of 100: 113.4

* *Real income: $63,688*

New Mexico

* Median household income: $45,382

* Regional price parity out of 100: 94.4

* *Real income: $48,074*

New York

* Median household income: $60,850

* Regional price parity out of 100: 115.3

* *Real income: $52,775*

North Carolina

* Median household income: $47,830

* Regional price parity out of 100: 91.2

* *Real income: $52,445*

North Dakota

* Median household income: $60,557

* Regional price parity out of 100: 92.3

* *Real income: $65,609*

Ohio

* Median household income: $51,075

* Regional price parity out of 100: 89.2

* *Real income: $57,259*

Oklahoma

* Median household income: $48,568

* Regional price parity out of 100: 89.9

* *Real income: $54,024*

Oregon

* Median household income: $54,148

* Regional price parity out of 100: 99.2

* *Real income: $54,585*

Pennsylvania

* Median household income: $55,702

* Regional price parity out of 100: 97.9

* *Real income: $56,897*

Rhode Island

* Median household income: $58,073

* Regional price parity out of 100: 98.7

* *Real income: $58,838*

South Carolina

* Median household income: $47,238

* Regional price parity out of 100: 90.3

* *Real income: $52,312*

South Dakota

* Median household income: $53,017

* Regional price parity out of 100: 88.2

* *Real income: $60,110*

Tennessee

* Median household income: $47,275

* Regional price parity out of 100: 89.9

* *Real income: $52,586*

Texas

* Median household income: $55,653

* Regional price parity out of 100: 96.8

* *Real income: $57,493*

Utah

* Median household income: $62,912

* Regional price parity out of 100: 97

* *Real income: $64,858*

Vermont

* Median household income: $56,990

* Regional price parity out of 100: 101.6

* *Real income: $56,093*

Virginia

* Median household income: $66,262

* Regional price parity out of 100: 102.5

* *Real income: $64,646*

Washington

* Median household income: $64,129

* Regional price parity out of 100: 104.8

* *Real income: $61,192*

West Virginia

* Median household income: $42,019

* Regional price parity out of 100: 88.9

* *Real income: $47,265*

Wisconsin

* Median household income: $55,638

* Regional price parity out of 100: 93.1

* *Real income: $59,762*

Wyoming

* Median household income: $60,214

* Regional price parity out of 100: 96.2

* *Real income: $62,593*

在這個基礎上再加上各州的稅率就可以看出真實收入(聯邦稅率各州一樣):

表格為排名,總稅率,地稅,個人所得稅,消費稅

Overall Tax Burden by State

Overall Rank

(1=Highest)

State

Total Tax Burden

(%)

Property Tax Burden

(%)

Individual Income Tax Burden

(%)

Total Sales & Excise Tax Burden

(%)

1 New York 13.04% 4.62% 4.78% 3.64% 2 Hawaii 11.57% 2.20% 2.85% 6.52% 3 Maine 11.02% 4.80% 2.69% 3.53% 4 Vermont 10.94% 5.20% 2.32% 3.42% 5 Minnesota 10.37% 3.00% 3.70% 3.67% 6 Connecticut 10.19% 4.17% 3.34% 2.68% 7 Rhode Island 10.14% 4.70% 2.31% 3.13% 8 Illinois 10.08% 4.11% 2.44% 3.53% 9 New Jersey 10.02% 5.12% 2.46% 2.44% 10 California 9.57% 2.66% 3.65% 3.26% 11 Ohio 9.48% 2.90% 2.71% 3.87% 12 Maryland 9.45% 2.77% 3.92% 2.76% 13 West Virginia 9.40% 2.43% 2.87% 4.10% 14 Iowa 9.32% 3.43% 2.50% 3.39% 14 Mississippi 9.32% 2.80% 1.72% 4.80% 16 Wisconsin 9.26% 3.52% 2.67% 3.07% 17 Nebraska 9.17% 3.83% 2.39% 2.95% 18 Massachusetts 9.03% 3.60% 3.40% 2.03% 19 Arkansas 8.99% 1.79% 2.29% 4.91% 20 New Mexico 8.94% 2.03% 1.75% 5.16% 21 Kentucky 8.79% 2.03% 3.16% 3.60% 22 North Dakota 8.69% 2.20% 1.28% 5.21% 23 Pennsylvania 8.66% 2.98% 2.56% 3.12% 24 Indiana 8.56% 2.33% 2.33% 3.90% 25 Kansas 8.54% 3.07% 1.66% 3.81% 26 Michigan 8.53% 3.21% 2.18% 3.14% 27 Louisiana 8.43% 2.03% 1.49% 4.91% 28 Oregon 8.38% 3.17% 4.10% 1.11% 29 Utah 8.36% 2.46% 2.66% 3.24% 30 North Carolina 8.32% 2.30% 2.70% 3.32% 31 Arizona 8.21% 2.62% 1.39% 4.20% 31 Nevada 8.21% 2.23% 0.00% 5.98% 33 Texas 8.15% 3.70% 0.00% 4.45% 33 Washington 8.15% 2.66% 0.00% 5.49% 35 Colorado 8.10% 2.67% 2.26% 3.17% 36 Georgia 8.09% 2.75% 2.31% 3.03% 37 Wyoming 8.03% 4.17% 0.00% 3.86% 38 Missouri 7.95% 2.34% 2.42% 3.19% 39 South Carolina 7.88% 2.91% 1.97% 3.00% 40 Idaho 7.87% 2.48% 2.30% 3.09% 41 Virginia 7.77% 2.92% 2.73% 2.12% 42 Montana 7.64% 3.55% 2.69% 1.40% 43 Alabama 7.24% 1.41% 1.86% 3.97% 44 South Dakota 7.22% 2.90% 0.00% 4.32% 45 Oklahoma 7.17% 1.54% 1.89% 3.74% 46 New Hampshire 7.07% 5.60% 0.13% 1.34% 47 Florida 6.64% 2.72% 0.00% 3.92% 48 Tennessee 6.47% 2.05% 0.11% 4.31% 49 Delaware 5.68% 1.82% 2.70% 1.16% 50 Alaska 4.94% 3.54% 0.00% 1.40%

稅率第1到第10是:

紐約州:總稅率13.04%,夏威夷11.57%,緬因州 11.02%, 佛蒙特州 10.94%, 明尼蘇達10.37%, 康乃迪格 10.19% 羅德島10.14% 伊利諾 10.08%, 紐澤西 10.02%, 加利福尼亞9.57%

稅率倒數第一。。。還是阿拉斯加 4.94%...